One of the important decision for business unit , Marketing and product managers in pharmaceutical industry are determining proper marketing strategy for their product mix (product range) which their company offer at same time. This decision is very important for cash flow to the company and product’s marketing plan.

One of famous matrix can help them in this decision is product portfolio analysis BCG matrix developed by Boston Consulting Group a business strategy and marketing consultancy in 1968.

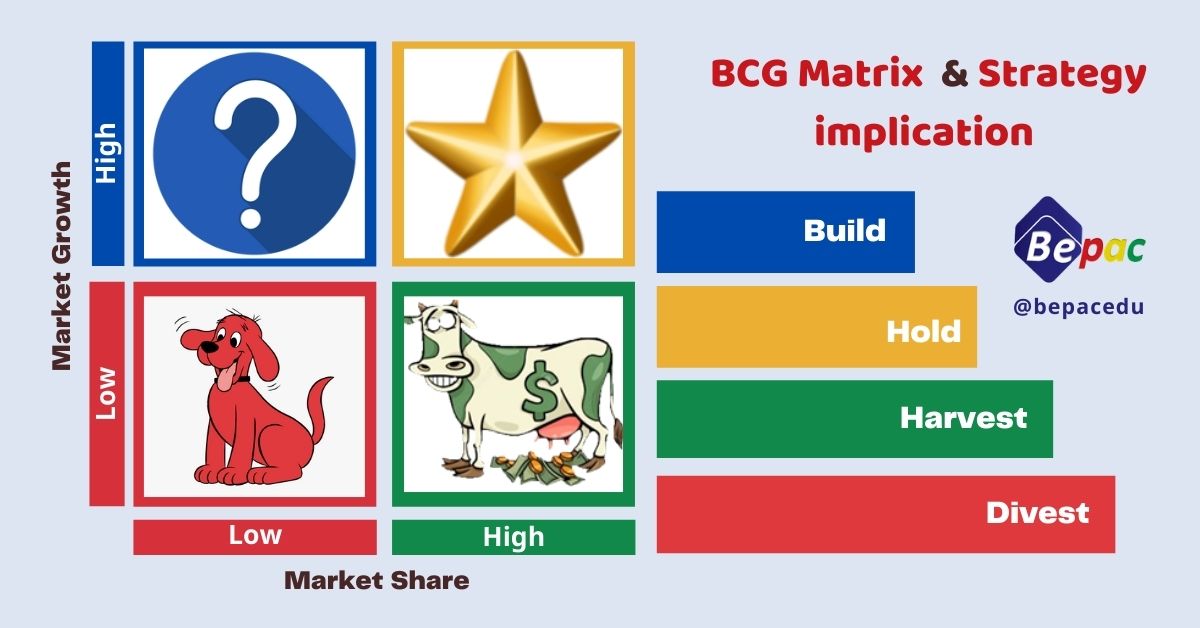

BCG matrix links product market growth with product market share this matrix represents four types of products:

Question market

Question mark or problem Childs are products which have low market share in high growth market. These product need money to spend in developing them. These products may produce negative cash flow but they are potential for the future. These products in introduction stage of PLC (product life cycle)

Stars

Stars are products which have high or increasing market share in high growth markets. These product are potential for high revenue and growth. These products in growth stage of PLC (product life cycle)

- Cash cows

Cash cow are products which have high market share in low growth market. These product need low cost to support and they produce high cash revenue and positive cash flows. These products in maturity stage of PLC (product life cycle).

- Dogs products

Dogs products which have low market share in low market growth. These products produce negative cash flow need large money to revive or support. These products in decline stage of PLC (product life cycle).

Now how business unit managers or product, marketing managers formulate the best strategy for each products categories. There are four strategies suggested for this matrix:

- Build strategy for question market products which have the chance to be in strong positions in the market. Build means invest in them if they are worthy to the future to transfer them to stars . If the products are not worthy for the future managers may choose to divest them from the portfolio to cut loses and secure the future.

- Hold strategy for stars products which are worthy for future and support with money to promote to stronger position in the market. The aim is to preserve market share and consider transferring them to cash cows.

- Harvest strategy for cash cows products to generate large cash flow from them to invest in other products like question mark and stars. Managers must think also about their performance in long term.

- Divest strategy for dogs’ products to remove or withdrawal them from the market to stop loses or think about the cost to revive them again.

Although BCG matrix is famous and easy to apply by two parameters some criticism for it like:

- Not all dogs’ product produce negative cash flow and company can get positive cash flow from them, also can preserve them to maintain customers’ relation or to revive them in the future.

- Cash cows need money to support because they are market leaders and face tough competition from challengers and followers. They must defense their market share.

- Market Growth rate is an inadequate descriptor of overall industry attractiveness. There are others factors can be considered

Follow us we will discuss the relation between this BCG matrix and implication strategies in sales function.

Written by Dr. Mohamed Shehab All rights reserved to Bepacedu / @seomenta.com